|

Understanding Politics & Wall Street

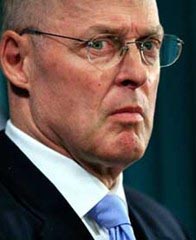

Who is Henry Paulson?

Tom Eley, at WSWS, 23 September 2008

[see also Global

Priority: Feed the Markets, Starve the Hungry - Devinder Sharma and

Understanding Financial Mania

and Systemic Risk - 'Leveraged Buy Outs', 'Private Equity', 'Hedge Funds' -

An interview with Damon Silvers ]

The

plan to rescue the US financial industry arrogates virtually unlimited money and

power over the financial affairs of the state to the office of Treasury

Secretary Henry Paulson. Paulson is a figure with a long history of intimate

connections to the political and financial elite. The

plan to rescue the US financial industry arrogates virtually unlimited money and

power over the financial affairs of the state to the office of Treasury

Secretary Henry Paulson. Paulson is a figure with a long history of intimate

connections to the political and financial elite.

In 1970, fresh from the Masters program of the Harvard Business School, Paulson

entered the Nixon administration, working first as staff assistant to the

assistant secretary of defense. In 1972-73, Paulson worked as office assistant

to John Erlichman, assistant to the president for domestic affairs. Erlichman

was one of the key figures involved in organizing President Richard Nixon�s

notorious �plumbers� unit that carried out illegal covert operations against the

president�s political opponents, including espionage, blackmail, and revenge.

Ehlichman resigned in 1973, and in 1975 he was convicted of obstruction of

justice, perjury, and conspiracy, and was imprisoned for 18 months.

Utilizing his connections, Paulson went to work for Goldman Sachs in 1974. In a

2007 feature, the British newspaper the Guardian wrote, �Not only was he well

connected enough to get the job [in the Nixon White House], but well connected

enough to resign in the thick of the Watergate scandal without ever getting

caught up in the fallout. He went straight to Goldman back home in Illinois.�

Paulson rose through the ranks of Goldman Sachs, becoming a partner in 1982,

co-head of investment banking in 1990, chief operating officer in 1994. In 1998

he forced out his co-chairman Jon Corzine �in what amounted to a coup,�

according to New York Times economics correspondent Floyd Norris, and took over

the post of CEO.

Goldman Sachs is perhaps the single best-connected Wall Street firm. Its

executives routinely go in and out of top government posts. Corzine went on to

become US senator from New Jersey and is now the state�s governor. Corzine�s

predecessor, Stephen Friedman, served in the Bush administration as assistant to

the president for economic policy and as chairman of the National Economic

Council (NEC). Friedman�s predecessor as Goldman Sachs CEO, Robert Rubin, served

as chairman of the NEC and later treasury secretary under Bill Clinton.

Agence France Press, in a 2006 article on Paulson�s appointment, �Has Goldman

Sachs Taken Over the Bush Administration?� noted that, in addition to Paulson,

�[t]he president�s chief of staff, Josh Bolten, and the chairman of the

Commodity Futures Trading Commission, Jeffery Reuben, are Goldman alumni.�

�But the flow goes both ways,� the article continued, �Goldman recently hired

Robert Zoellick, who stepped down as the US deputy secretary of state, and

Faryar Shirzad, who worked as one of Bush�s national security advisors.�

Prior to being selected as treasury secretary, Paulson was a major individual

campaign contributor to Republican candidates, giving over $336,000 of his own

money between 1998 and 2006.

Since taking office, Paulson has overseen the destruction of three of Goldman

Sachs� rivals. In March, Paulson helped arrange the fire sale of Bear Stearns to

JPMorgan Chase. Then, a little more than a week ago, he allowed Lehman Brothers

to collapse, while simultaneously organizing the absorption of Merrill Lynch by

Bank of America. This left only Goldman Sachs and Morgan Stanley as major

investment banks, both of which were converted on Sunday into bank holding

companies, a move that effectively ended the existence of the investment bank as

a distinct economic form.

In the months leading up to his proposed $700 billion bailout of the financial

industry, Paulson had already used his office to dole out hundreds of billions

of dollars. After his July 2008 proposal for $70 billion to resolve the

insolvency of Fannie Mae and Freddie Mac failed, Paulson organized the

government takeover of the two mortgage-lending giants for an immediate $200

billion price tag, while making the government potentially liable for hundreds

of billions more in bad debt. He then organized a federal purchase of an 80

percent stake in the giant insurer American International Group (AIG) at a cost

of $85 billion.

These bailouts have been designed to prevent a chain reaction collapse of the

world economy, but more importantly they aimed to insulate and even reward the

wealthy shareholders, like Paulson, primarily responsible for the financial

collapse.

Paulson bears a considerable amount of personal responsibility for the crisis.

Paulson, according to a celebratory

2006 BusinessWeek article entitled �Mr. Risk Goes to Washington,� was �one

of the key architects of a more daring Wall Street, where securities firms are

taking greater and greater chances in their pursuit of profits.� Under Paulson�s

watch, that meant �taking on more debt: $100 billion in long-term debt in 2005,

compared with about $20 billion in 1999. It means placing big bets on all sorts

of exotic derivatives and other securities.�

According

to the International Herald Tribune, Paulson �was one of the first Wall

Street leaders to recognize how drastically investment banks could enhance their

profitability by betting with their own capital instead of acting as mere

intermediaries.� Paulson �stubbornly assert[ed] Goldman�s right to invest in,

advise on and finance deals, regardless of potential conflicts.�

Paulson then handsomely benefited from the speculative boom. This wealth was

based on financial manipulation and did nothing to create real value in the

economy. On the contrary, the extraordinary enrichment of individuals like

Paulson was the corollary to the dismantling of the real economy, the

bankrupting of the government, and the impoverishment of masses the world over.

Paulson was compensated to the tune of $30 million in 2004 and took home $37

million in 2005. In his career at Goldman Sachs he built up a personal net worth

of over $700 million, according to estimates.

After Paulson�s ascension to the treasury, his colleagues at Goldman Sachs

carried on the bonanza. At the end of 2006, Paulson�s successor Lloyd Blankfein

was handed over a $53.4 million year-end bonus, while 11 other Goldman Sachs

executives raked in $150 million in year-end bonuses combined. That year, the

top investment firms Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman

Brothers, and Bear Stearns handed out $36 billion in bonuses. At the end of

2007, the executives of the same firms, excepting Merrill, were handed another

$30 billion. |